Regarding the demand for an increase in civil servants' and retiree’s salaries, which came to the fore after the minimum wage hike, the The Confederation of Public Servants Trade Union (Memur-Sen) delegation had a meeting with President Recep Tayyip Erdoğan in the past few days. In the statement made by Memur-Sen after the meeting, “it was stated that with the arrangement done, the wages corresponding to the remaining amount after deducting the worker's social security institution premium and unemployment insurance premium from the monthly gross amount of the minimum wage will be exempt from income tax. However, a clear information, data, source and example regarding the arrangement has not been disclosed by the public finances,” it is said. A call is made in the statement for an official statement on the arrangement.

CALCULATIONS ARE CHANGING DUE TO DIFFERENT EMPLOYMENT TYPES

It was pointed out that public servants are employed in two different ways as contracted and permanent staff in terms of status, and it was emphasized that these 2 different status distinctions cause differences in every issue. In the statement, "Permanent public servants' income tax base amounts are lower than contracted public servants, and the monthly tax base of permanent public servants is between 2,300 Turkish Liras (TL) and 3,000 TL on average. The income tax calculated over these amounts is calculated by deducting from the minimum living allowance (AGI) amounts that vary according to the status of the civil servant,” it is added.

MINISTRY OF FINANCE SHOULD CLARIFY THE SUBJECT

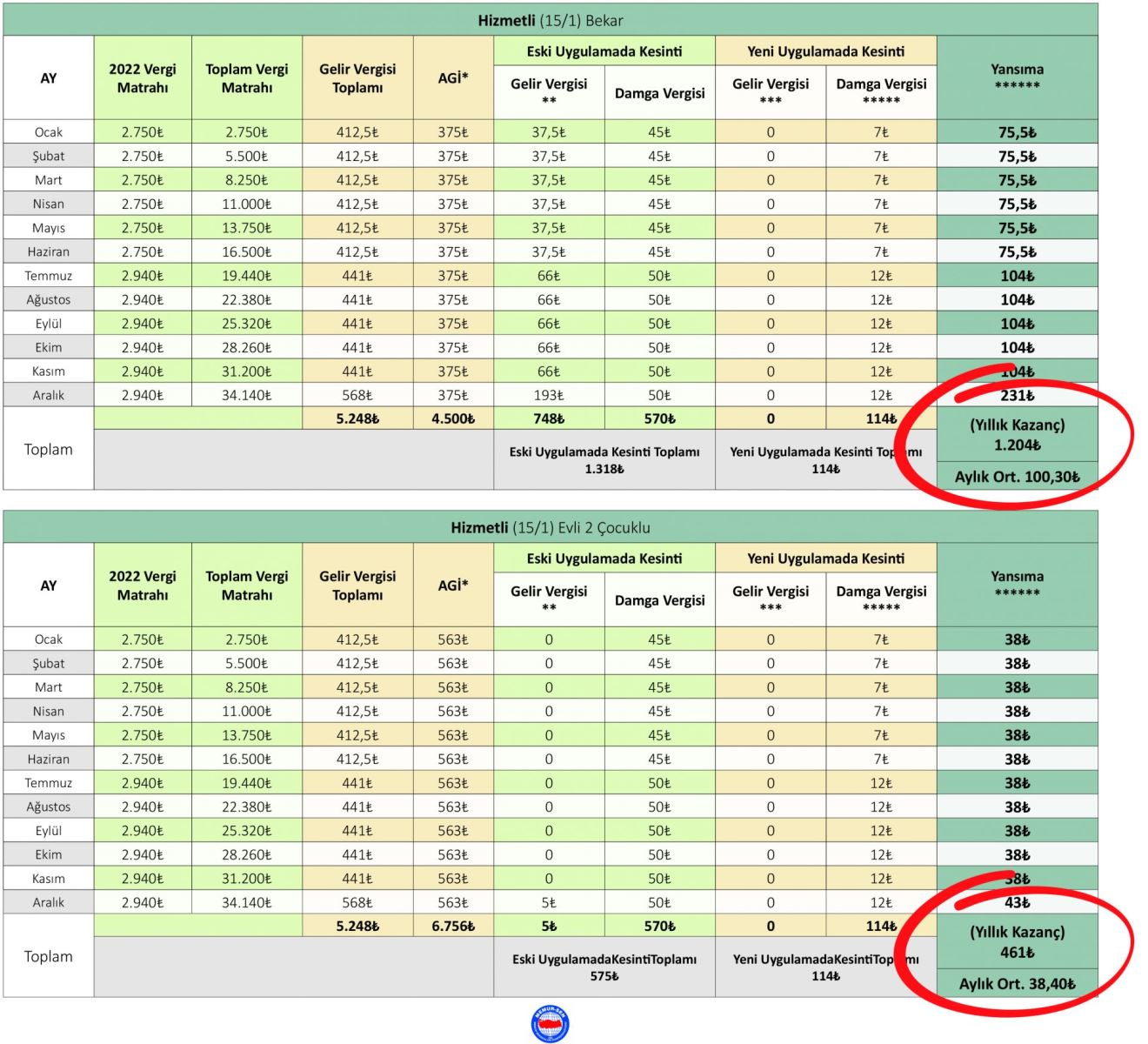

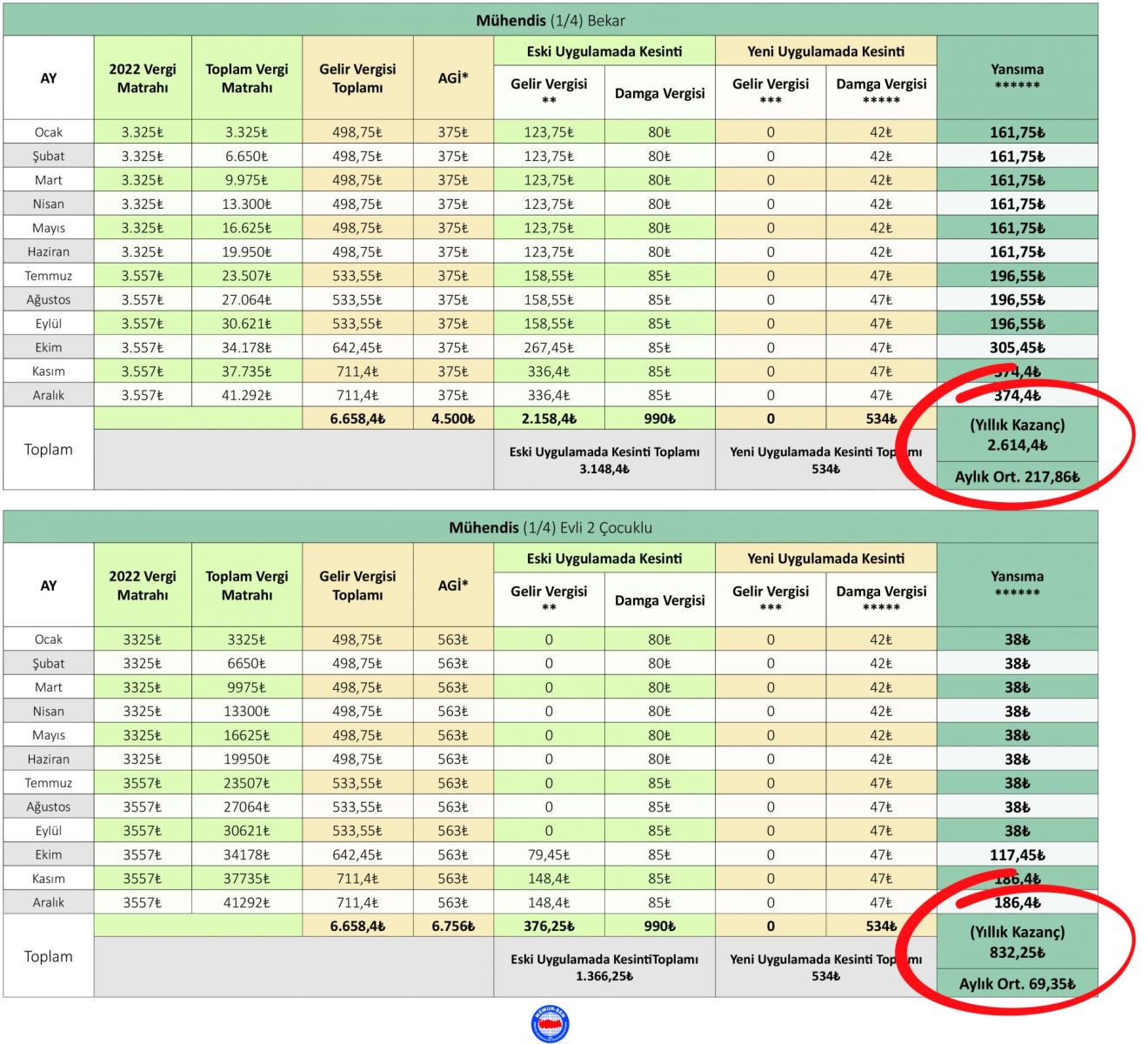

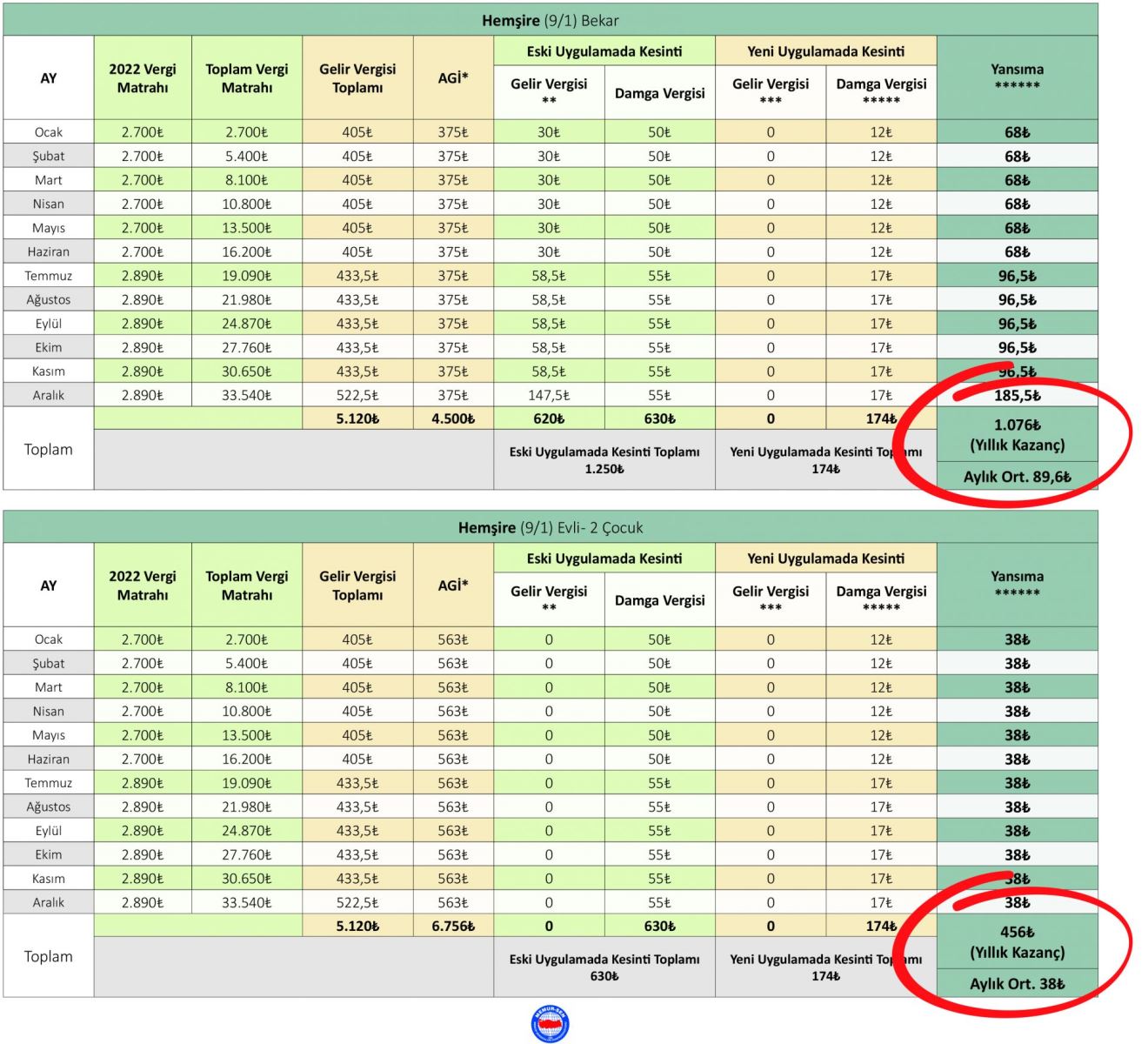

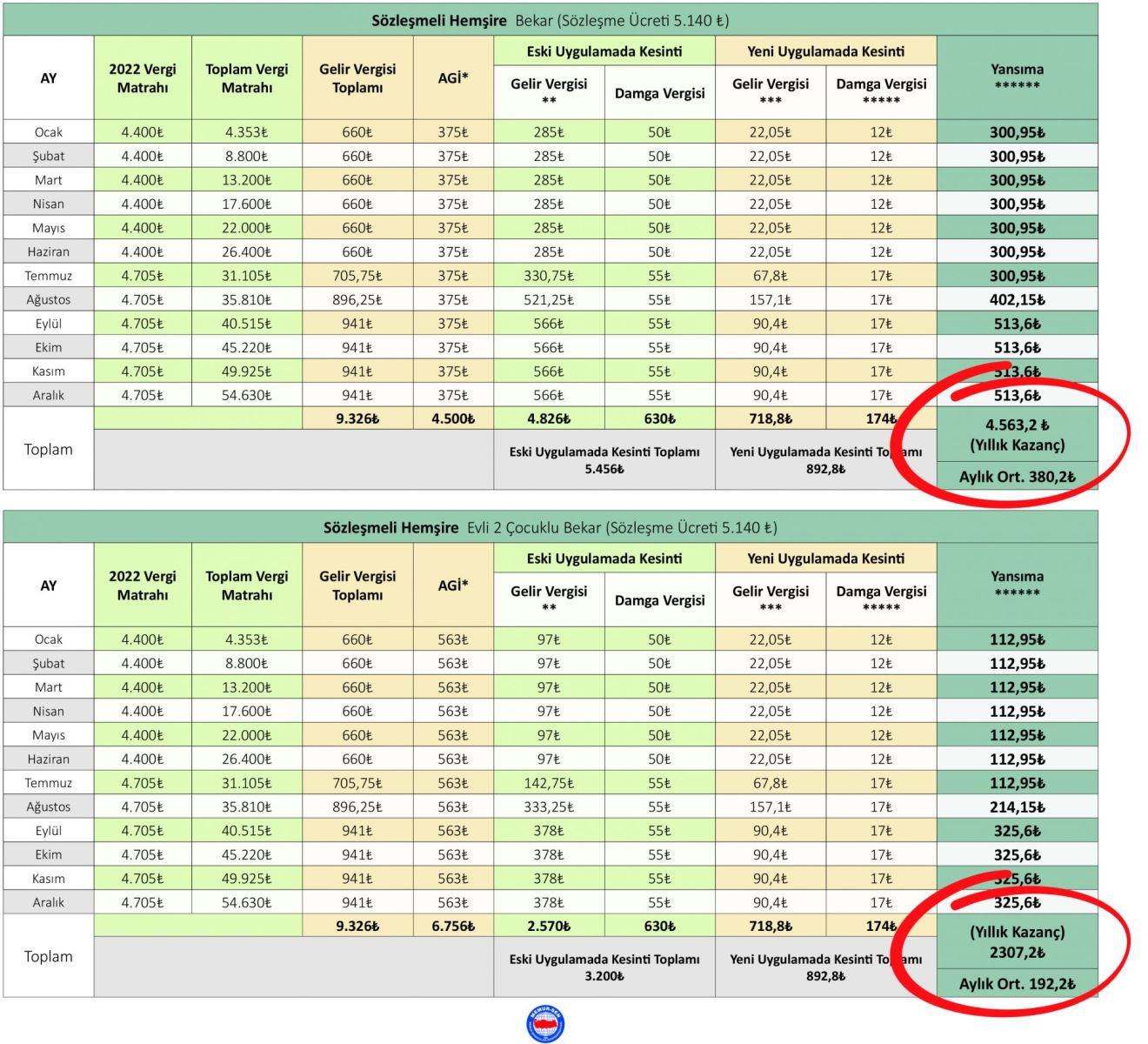

Pointing out that the AGI amount, which varies in cases where the civil servant is married and has children, is generally higher than the income tax, resulting in the non-payment of the increased amount, the statement said, “With the new regulation, an average of 300 TL per month for permanent civil servants is not brought by the new regulation. It is seen that the monthly average is 38 TL for the employee. Due to the the basic elements of the tax base of State Economic Enterprise (SEE) personnel, contracted, administrative service contracted and personnel employed under different titles, are higher than the permanent civil servants, they fall into the 20 percent and 27 percent tax brackets in the early months, and the reflection of the exemption on their salaries is higher.In this context, we reveal the tables that show increase in salaries caused by the tax exemption for permanent and contracted personnel and invite the Ministry of Finance to clarify the issue as soon as possible so that the public will get rid of the confusion of information.”

TABLES AND REFLECTIONS EXPOSED

Memur-Sen, who shared the tables they prepared regarding the new regulation with the public, revealed the differences that the employees will receive in the new regulation. According to the tables shared with the public by Memur-Sen, a single teacher at 9 to 1 level costs 72,76 TL per month, a married teacher with 2 children at 9 to 1 level costs 38 TL per month, a single contracted teacher costs 380,2 TL per month and a contracted teacher with 2 children will be reflected in their salaries of 192,2 TL. 89,6 TL per month for the salary of a single nurse at 9 to 1 level, 38 TL per month for a married nurse with 2 children, 380,2 TL per month for a single contracted nurse, 192,2 TL per month for a contracted married nurse with 2 children. While 217,86 TL will be reflected on the monthly salary of a single engineer at 1 to 4 levels, 69,35 TL will be reflected to the monthly salary of a married engineer with 2 children at 1 to 4 levels. The monthly salary of a single contracted engineer will be 380,26 TL, and the monthly salary of a contracted married engineer with 2 children will be 192,25 TL. The monthly salary of a single employee working at the 15 to 1 level will be 100,30 TL, and the monthly salary of a married employee with 2 children will be 38,40 TL, again at the 15 to 1 level.

.jpg)

.jpg)

.jpg)